According to recent studies, a single person needs an average of $545,000 in retirement savings, while a couple needs approximately $640,000.

The Australian government provides a safety net for retirees through the Age Pension, which is a means-tested payment that provides a basic level of income support to eligible seniors. However, for those who wish to retire with more financial security, additional savings and investments may be necessary.

To determine how much money you need to retire, it's important to consider your current expenses and estimate your future costs. Some of the factors that may impact your retirement expenses include housing, healthcare, transportation, and leisure activities.

It's also important to consider any outstanding debts, such as a mortgage or credit card balances, and make a plan to pay them off before retiring.

To build retirement savings, many Australians choose to invest in superannuation, which is a tax-effective way to save for retirement. Employers are required to contribute a minimum of 10% of their employee's salary to a superannuation fund, and employees can also make voluntary contributions.

In addition to superannuation, retirees may also have other sources of income, such as rental income, dividends from investments, or income from part-time work. It's important to consider all sources of income when estimating retirement expenses and planning for retirement.

Ultimately, the amount of money needed to retire in Australia will depend on a variety of factors unique to each individual. By carefully considering your expenses, sources of income, and future goals, you can develop a retirement plan that provides financial security and peace of mind.

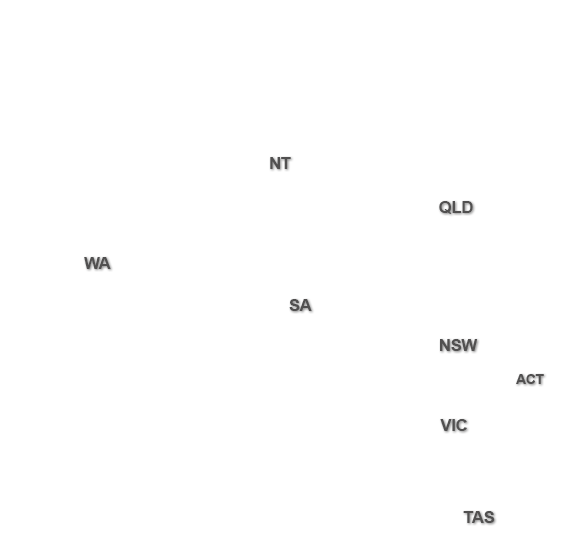

Search for retirement villages near you by clicking on your state below:

- ACT

- New South Wales

- Northern Territory

- Queensland

- South Australia

- Tasmania

- Victoria

- Western Australia

Article posted:May 3, 2023 Category: Finance